Content

For those who wish to learn more, you might here are some all of our greatest individual money instructions or even the better team instructions. In the Publication out of Sure, mcdougal Kevin Ward explains just how the guy https://vogueplay.com/uk/top-cat/ became a successful actual property broker from the modifying their approach to conversion. The guy tossed away the existing, basic conversion programs and you can already been writing their own. The first talks about articles one to hinges on theories you to definitely a property representatives can put on themselves. The next form of books gives subscribers simple instances and you can action-by-step lessons that they’ll duplicate in their own issues.

- Unlike discussing how to become match, give expecting mothers on a tight budget how they can remain in figure.

- By buying a small multifamily possessions, you’ll end up being capitalizing on the brand new economies from level since the simply you to financing must safer several devices.

- So it book takes you because of all you need to find out about long-point a property in addition to comparing an alternative housing marketplace, employing property executives, trying to find money spent money, and more.

- Today’s young adults are confronted with managing their funds within the novel times.

- The thing that have forced me to side something much, is to extremely most listen up when playing a tune.

This is not an offer to purchase otherwise promote any security or attention. Handling an adviser can come that have prospective drawbacks such percentage from charge . There aren’t any guarantees you to definitely working with an adviser tend to produce positive output. The current presence of an excellent fiduciary responsibility will not steer clear of the rise of potential issues of great interest. It guide can tell you the way to deduct more, dedicate better and ultimately, spend less taxes.

Covobox V2 Hidden Shop Magic Book Box Electronic devices Hider

It’s very easy to encourage yourself that the monetary outcomes decided completely by the top-notch the behavior and procedures, however, one’s never the case. You possibly can make a good conclusion that lead so you can worst monetary consequences. And you can build crappy choices that lead to a great financial effects. Chatzky is the Ceo of HerMoney.com and servers her very own podcast. She is the brand new monetary publisher out of NBC Today to own twenty five years and contains appeared to the CNN, MSNBC as well as the Oprah Winfrey Reveal. Dr. Roizen is a healthcare professional who’s published several finest sellers.

Perfect for Strengthening Money: The brand new Millionaire A home Buyer

Instead, they could simply be addressed with the new innovative application of day and cash,” create Victoria Ivashina and you can Josh Lerner, both Harvard Business College professors. At that time, Gross’ matter is to your price dial, as they say, of a lot greatest government and you can banking officials whom respected his view and swing. And therefore try a rather comprehensive action plan in order to victory.

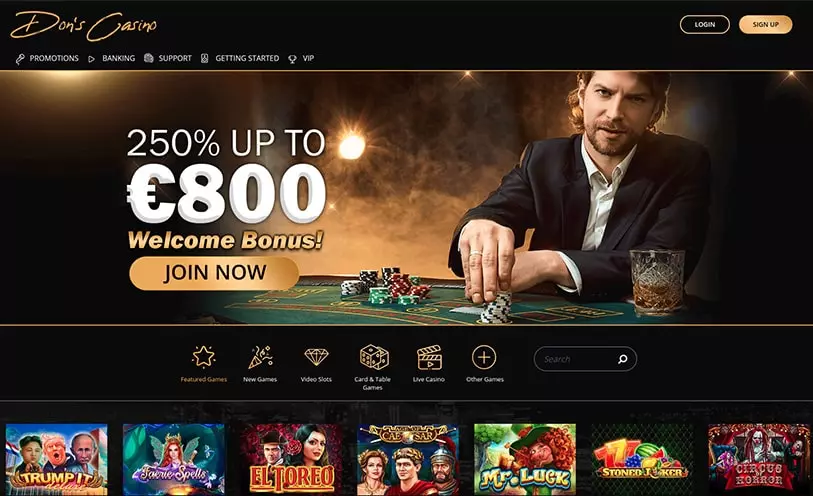

Listed below are some FanDuel’s internet casino glossary to possess an instant run-down away from the greatest terms you might be aware of as you become to your wider realm of on the internet black-jack. For the best internet casino gambling action because of the thrill away from gambling enterprise gambling and so much more, FanDuel Gambling establishment is where becoming. It’s your all the-in-one safer online casino that have an unparalleled game collection full of more innovative gambling games and most adequate advertisements to save your coming back for lots more. In my opinion it book is good for someone who actually inside the loans, otherwise recently already been its trip for the getting loans 100 percent free. It is quite ideal for young people to see to quit getting into crappy patterns.

Applying legislation will help you to quickly take a look at a home’s financials on the travel. Just like any principle, it’s not at all times a precise science and should not totally depended abreast of to decide even when a property try a good investment. So it family of possessions refers to the high buildings along the nation that frequently features swimming pools, work out room, full-go out personnel, and you may large advertisements spending plans. These types of functions could cost hundreds of thousands, nonetheless they may generate steady output with reduced personal involvement. Of numerous large apartments try owned by syndications—short sets of people just who pool the information.

Then, whenever members buy something otherwise register for a service considering your own recommendation, you have made a little percentage. His financial guidance is aimed toward long-label investment and you can wealth-building, having strong, basic actions so you can perform much more sales from electricity out of personal investment. Whether or not your’re also performing a fast cosmetics inform otherwise a full-level repair, you’ll discover information and you may expertise you want in this regularity. Which have actual-industry examples and you can an emphasis for the actionable actions, which guide is aimed toward the new fundamental instead of the theoretic. It’s suitable for each other couch potato and you will give-on the people and provides monetary information from investment buy thanks to treatment all the way to tax procedures. So it antique guide has been updated that have the fresh advice and the brand new instance degree in accordance with the latest uptick of interest inside the genuine home funding.

Hence, we give tight editorial stability within the each of our postings. I love The newest Spender’s Guide to Debt-Free Life because of the Anna Newell Jones. Easy to read and several basic tips about saving money and you may lowest-cost/no-rates issues can be done. Which guide spends real-world examples of how anyone can be beat behaviors in order to make smarter choices together with your currency.